In the end, City Council approved another tax break for Bedrock. On Tuesday, during City Council's last session until September, the additional $60 million tax break for the Hudson's Site was approved, with added stipulations.

Council voted 5-4 in favor of the 10-year tax abatement for the development, well under construction. With the approval, City Council also stated that Bedrock must:

- Dedicate at least 20% of the storefronts to small businesses in Detroit

- Provide $1 million in small business development support

- Provide $5 million for community-based projects (home repairs, blight removal, home repairs for those in need) through the Neighborhood Improvement Fund

- Increase the amount of affordable housing in Bedrock properties from 20 to 30 percent, and moving the AMI level from 80 to 60 percent.

- Expand support for technology skills and digital equity

“In a perfect world, we would not need to offer tax abatements to developers to attract projects to the city of Detroit," said City Council President Mary Sheffield. "Unfortunately, Detroit has one of the highest tax rates in the nation amongst other major cities, and putting us at a competitive disadvantage, so tax abatements are a symptom of a much larger problem.”

The project initially had costs of $909 million when it broke ground in late 2017. Costs are now projected at $1.4 billion.

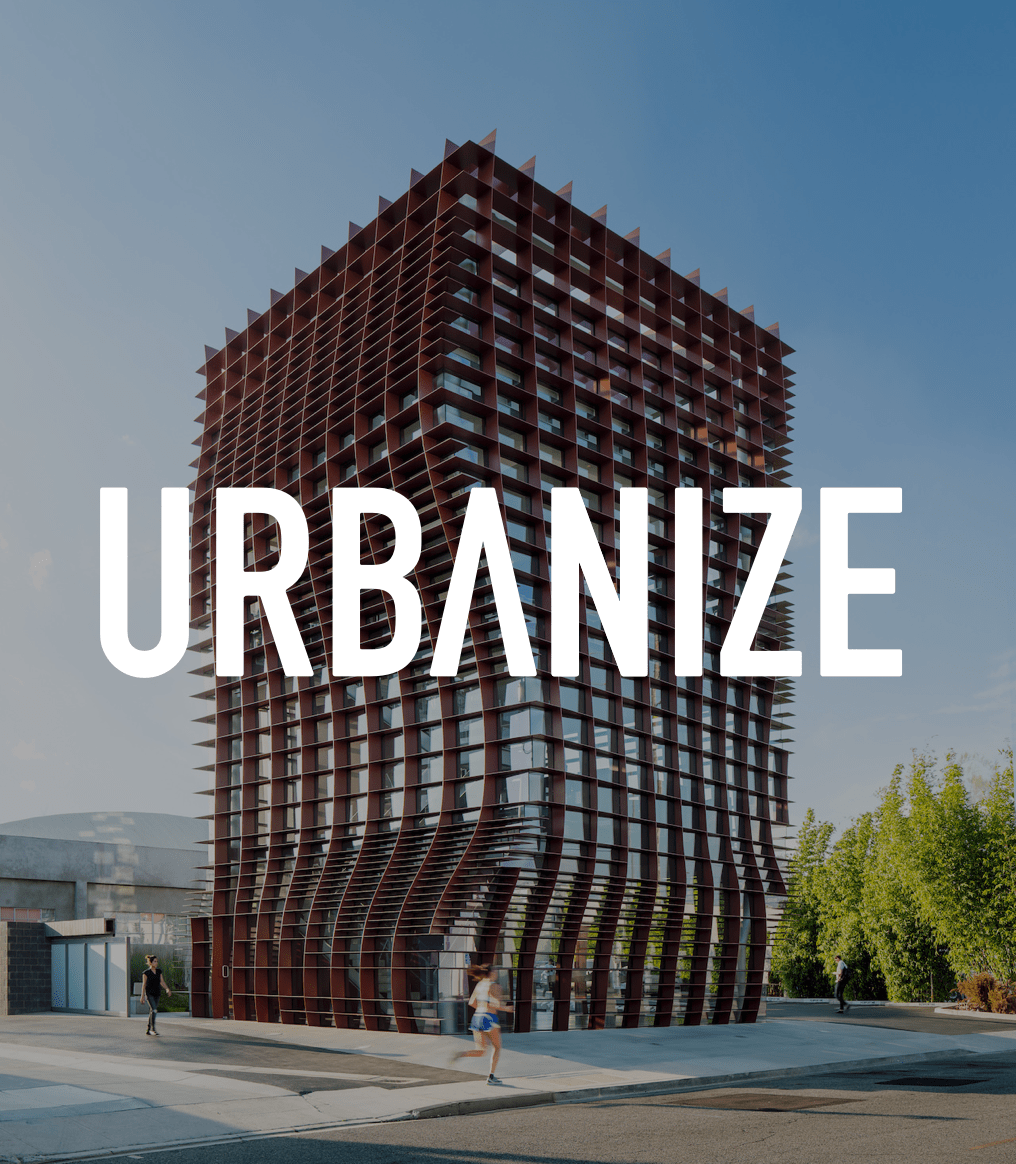

Bedrock released new renderings of the project earlier this year. The Hudson's site includes a tower with residential and hotel space, plus a 13-story building with event, office, and retail space. It should be completed in 2024.